Índice

We are all looking forward to it arriving every month, it is always well received and, unlike some visits, we try to make it last as long as possible, what is it?: effectively, the payroll. That document that assigns each worker their remuneration and that must be issued along with proof of payment to certify that the company has fulfilled its duty. However, almost no one stops to look at each section of their payroll, since, in many cases, we do not understand them.

Would you like to know how to read each section of your payroll and know the types that exist? Keep reading this post and find out everything!

There are mainly two categories of payroll: those based on time worked and those that are determined according to the job held. Now let’s delve into the description of each of them.

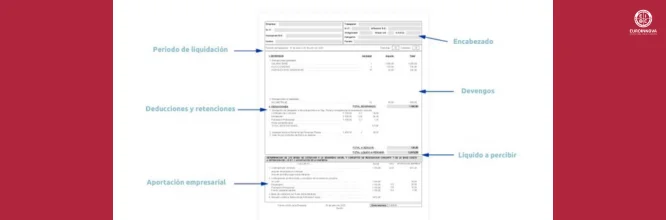

To finish this post, we want to leave you with this example of a payroll so that, when you receive yours, you know how to locate each section perfectly.

When preparing payrolls, confidential information of each employee is used, therefore, to ensure data protection during the process, the following aspects are contemplated, subject to the General Data Protection Regulation (RGDP) and the Organic Law of Protection of Personal Data and guarantee of digital rights (LOPDGDD).

Pseudonymization: in the event of a security crisis, it must be ensured that it is not known who owns the data.

Data encryption: IT systems for payroll management must have an encryption code to guarantee the protection of employees’ data.

Access restriction: it is essential to focus on preventing third-party attacks and preventing hackers from accessing payrolls or databases that store confidential information.

Data minimization: only personal data essential to carrying out settlements should be stored and processed.

You may be interested in reading about...

¡Muchas gracias!

Hemos recibido correctamente tus datos. En breve nos pondremos en contacto contigo.